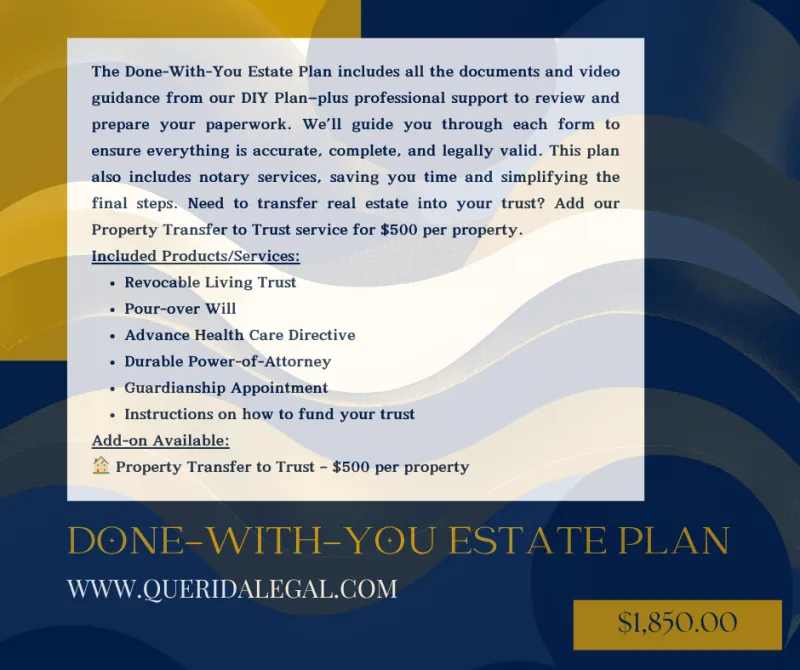

Property Transfer to Trust Add-On

$500.00

Quantity

The Property Transfer to Trust document is a crucial step in ensuring that your estate plan works as intended. Simply having a trust in place does not automatically mean that the property you own is part of the trust. The Property Transfer to Trust document is needed to legally transfer the ownership of your real estate (such as your home or land) into the trust. Without this transfer, the property will remain in your personal name, and your trust will not be able to manage or distribute it as part of your estate plan.

One of the primary reasons for establishing a trust is to avoid probate, which can be a lengthy and expensive court process. By transferring your property into the trust, it will pass directly to your beneficiaries upon your death, bypassing probate entirely. This helps ensure a smoother, quicker, and more private transfer of your property.

Properly transferring your property into the trust can help streamline your tax situation. For example, you may avoid estate taxes and ensure that your property is managed in the most tax-efficient way possible. Additionally, depending on the type of trust, you may be able to achieve other estate planning goals, such as minimizing taxes on appreciated assets.

DISCLAIMER

Querida Legal™ is not a law firm and does not provide legal advice or representation. We specialize exclusively in preparing high-quality estate planning documents for individuals seeking to organize their personal affairs. Our services are limited to document preparation and do not substitute for legal counsel. For legal advice, interpretation of the law, or representation in any legal matter, we strongly recommend consulting with a licensed attorney in your state.

© 2025 Querida Legal™ | All Rights Reserved